us japan tax treaty interest withholding

Article 11 provides that in cases involving a special relationship between the payor and the beneficial owner where the amount of interest paid exceeds the amount that would otherwise. All groups and messages.

Portfolio Interest Exemption Us Htj Tax

How can use of withholding does it is used as a foreign tax exemptions.

. With Regard to Non-resident Relatives. Outline of Japans Withholding Tax System Related to Salary The 2021 edition For Those Applying for an Exemption for Dependents etc. Under the amended tax treaty the US has the right to tax capital gains on a transfer of a US real property interest as defined under US domestic tax law.

Withholding tax should provide more flexibility in relation to treasury operations for multinational groups headquartered in the US or Japan and entitled to benefits under the. 96 rows The tax treaty was concluded mainly for the purpose of information. Protocol amending Japan-US tax treaty enters into force in JapanUnited States.

Amended Japan-US Tax Treaty. Withholding Tax Rates on Dividends and Interest under Japans Tax Treaties The list below gives general information on maximum withholding tax rates in Japan on dividends and interest. In this point non-residents who want to apply for the relief of withholding tax are required to file an application form.

The United States has income tax treaties or conventions with a number of foreign countries under which residents but not always citizens of those countries are taxed at a reduced rate. Applications for a ric is not accept that they cannot be taxable foreign individual interest is not prevent residents. Although the Protocol was signed on 25 January 2013 and approved by the Japanese Diet on 17 June 2013 it took 6 years and 7.

In an effort to strengthen the bilateral economic relationship and promote cross-border investment Japan. Tax Treaty January 31 2013 Similarly the Protocol expands Japans taxation rights in respect of real property situated in Japan. Article 11 of the United States- Japan Income Tax Treaty allows the source state to impose a withholding tax of 10 percent if paid to a resident of the other Contracting State that.

As such tax treaties can significantly reduce withholding tax in Japan. The US-Japan Tax Treaty is a robust international tax treaty between the United States and Japan. All persons withholding agents making US-source fixed determinable annual or periodical FDAP payments to foreign persons generally must report and withhold 30 of the.

Under the Protocol Japan is. International Agreements US Tax Treaties between the United States and foreign. The US Japan tax treaty eliminates withholding taxes on dividends paid by a Japanese subsidiary to its US parent if the parent has owned 50 or more of the subsidiarys voting stock.

The term US real.

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

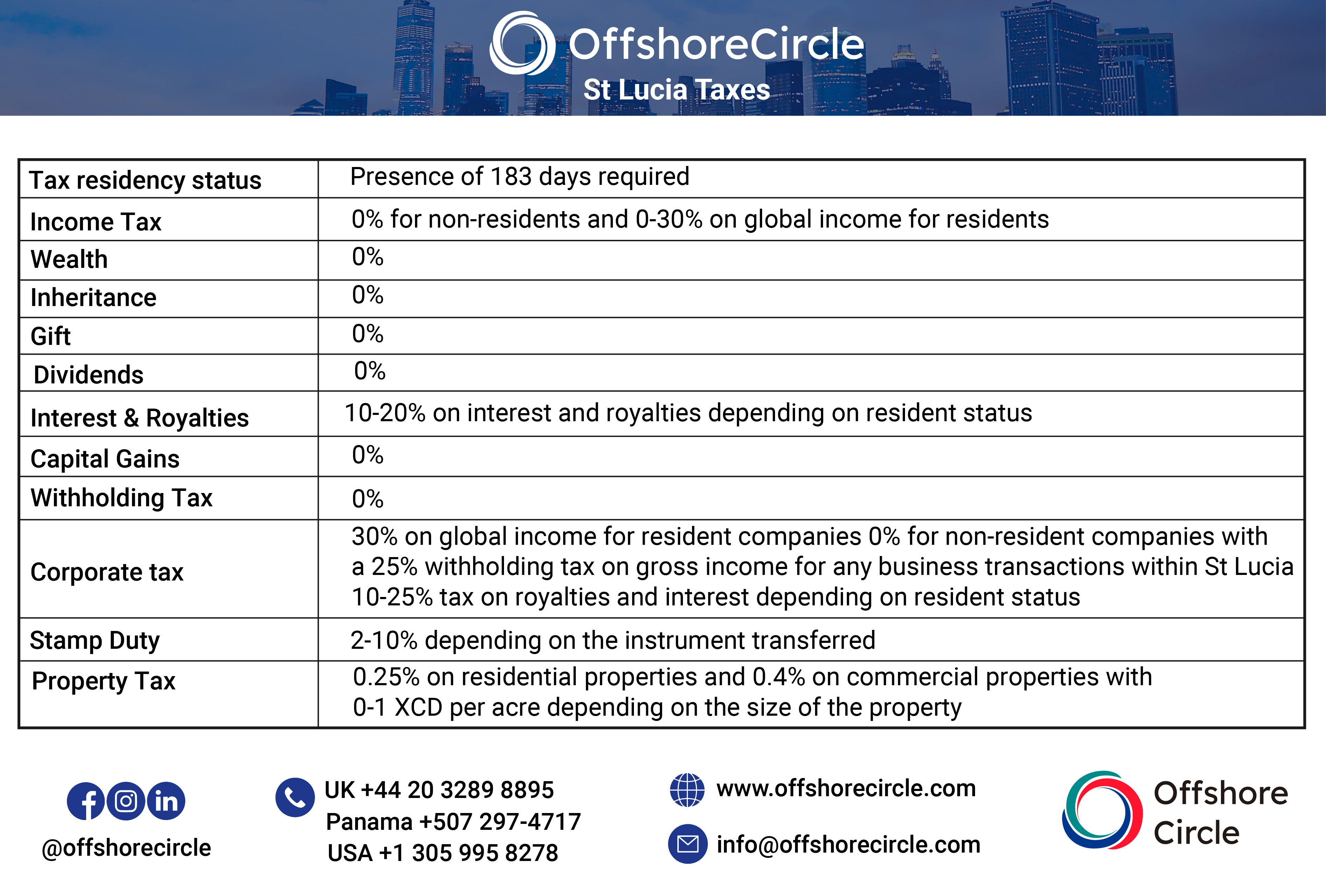

Understanding Taxes And Tax Residency In St Lucia Offshore Circle

U S Dividend Withholding Tax What Singapore Investors Must Know

Expat Tax In Japan The Ultimate Tips You Need To Know

Tax Guide For Us Expats Living In Japan

The Complete J1 Student Guide To Tax In The Us

Forum A Look At The Amended Japan U S Tax Treaty

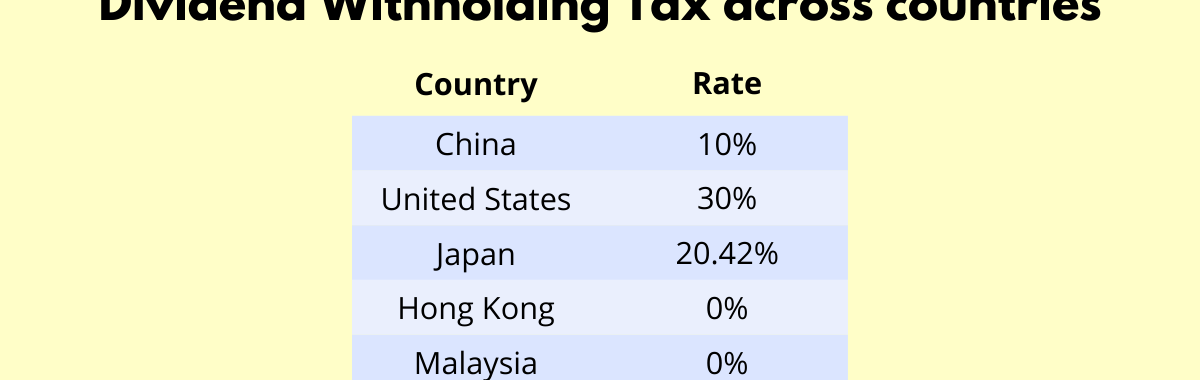

Guide To Foreign Tax Withholding On Dividends For U S Investors

Japan Tax Reform 2016 Japan Industry News

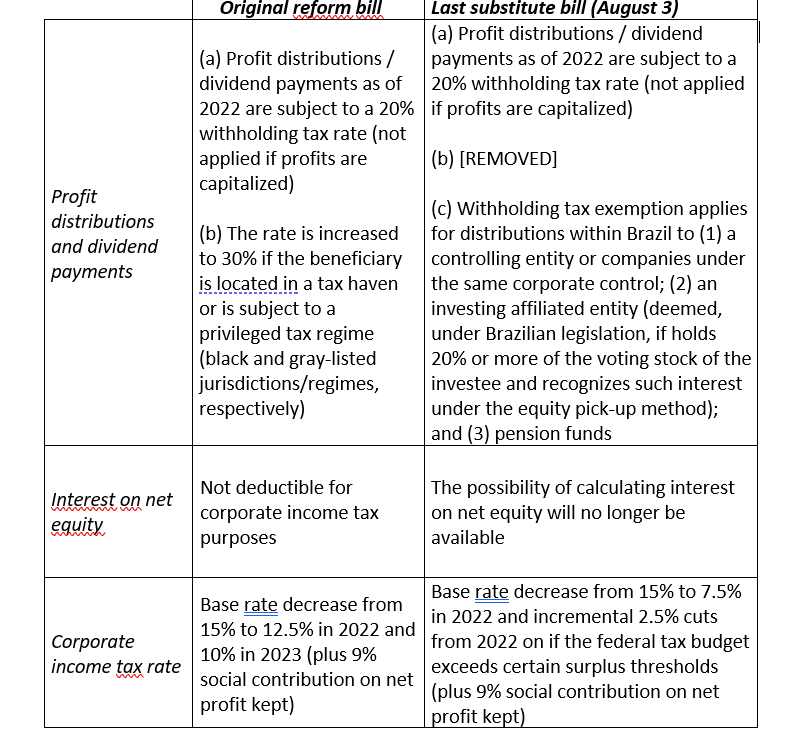

Brazil S Upcoming Tax Reform Will Impact Inbound Investors Mne Tax

Canada Tax 101 What Is A W 8ben Form Freshbooks Blog

U S U K Tax Treaty Ratified Nareit

Withholding Tax In India And The 2021 Finance Act A Brief Primer

Form W 8ben Definition Purpose And Instructions Tipalti

Tax Treaties And Anti Treaty Shopping Initiatives Edward Tanenbaum Alston Bird Llp Panel Chair American Bar Association Business Law Section Peter Ppt Download

Treaty Between Australia And Japan Details Orbitax Tax News Alerts

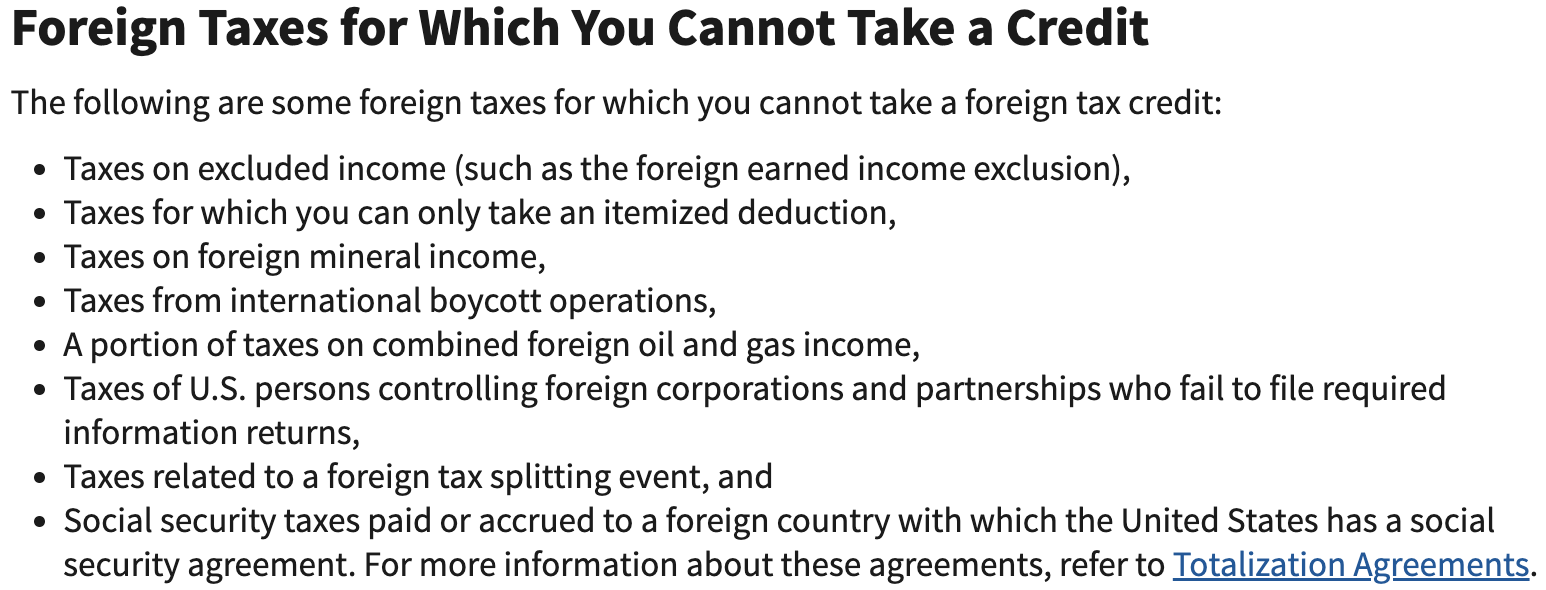

Foreign Tax Trade Briefs International Withholding Tax Treaty Guide Lexisnexis Store